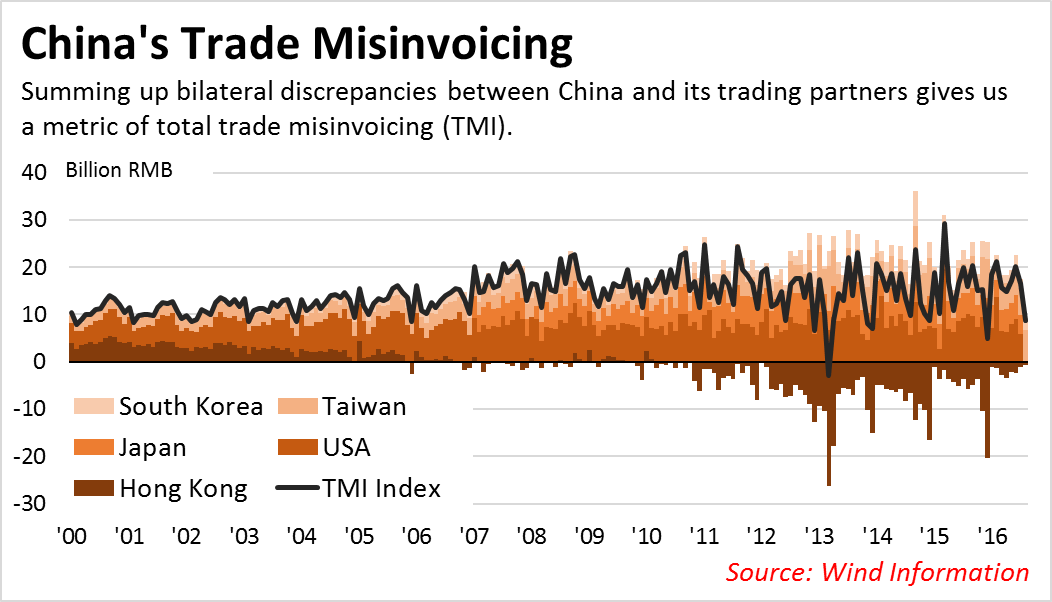

The current media consensus seems to be that trade misinvoicing (TMI) is the primary culprit of capital outflows from China. You can read stories on it here, here, and here. I’d like to introduce three separate datasets we can use to test that hypothesis.

The Center for Economic Policy Research summarizes the mechanism of TMI as it relates to capital outflows, as well a potential methodology for its detection, in this recent report:

The trade mis-invoicing measure is based on the fact that different statistical agencies record the same export/import activities, but often report different numbers. For instance, an export out of China worth $1,000 may enter the US statistics with a value of $1,000, but enter the Chinese statistics with a value of only $500. When abstracting from transportation costs this ‘under-invoicing’ of exports may be a sign of capital flight, as the remaining $500 is placed in a US bank account rather than being sent to China.

Based on that intuition, we can construct an aggregate measure of TMI using customs data from China’s largest trade partners. That is, we sum up the total difference between bilateral import and export data for China’s trade with the US, HK, Taiwan, Japan, and South Korea. A positive number implies capital outflows.

Presuming TMI were the primary mechanism for capital flight, we would expect to see a correlation between TMI and changes in China’s FX reserves. Most notably, we would expect a spike in TMI from mid-2014 through the end of 2015, when over $750 billion left the country.

However, a simple visual inspection reveals no relationship between TMI and changes in China’s FX reserves.

So, it is unlikely that hundreds of billions of dollars left the country through fraudulent import and export invoices as the practice is typically quantified.

An alternative explanation – that the Financial Times covered in March with the skeptical title, Chinese outflows ‘not driven by capital flight’ – is that capital outflows stem, “from mainland Chinese companies paying down cross-border debt.” The idea being that due to low interest rates in the US, Chinese firms had accumulated huge balances of USD loans, the unwinding of which led to billions of dollars in capital outflows.

We can test this hypothesis with two datasets: the SAFE International Investment Position data, and firm-level USD loan data from listed companies. Both datasets show that Chinese firms unloaded massive amounts of external debt from the end of 2014 through now. (The firm-level data is interesting in addition to the IIP data because we can use it to compare the magnitude of the carry trade across sectors.)

In sum, it is far more likely that China’s recent capital outflows are driven by corporate activity rather than panicked mainland Chinese trying to get their cash out of the country via trade misinvoicing. Additionally, given that the carry trade is almost completely unwound, this should no longer be a driver of capital outflows from China.